CLAIMSPLUS

Simplifying Claims, Enhancing Care: Your Path to Seamless Healthcare Management…

HOME > CLAIMSPLUS

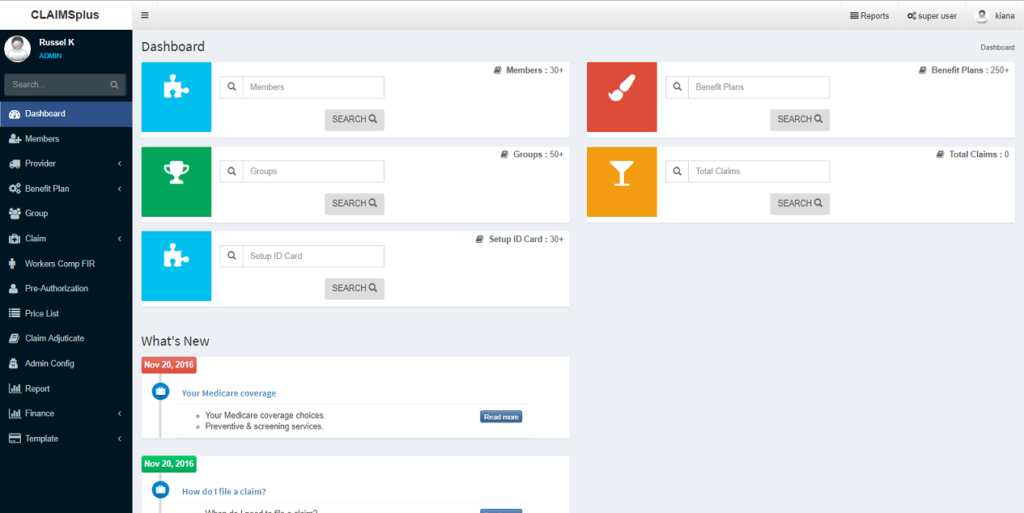

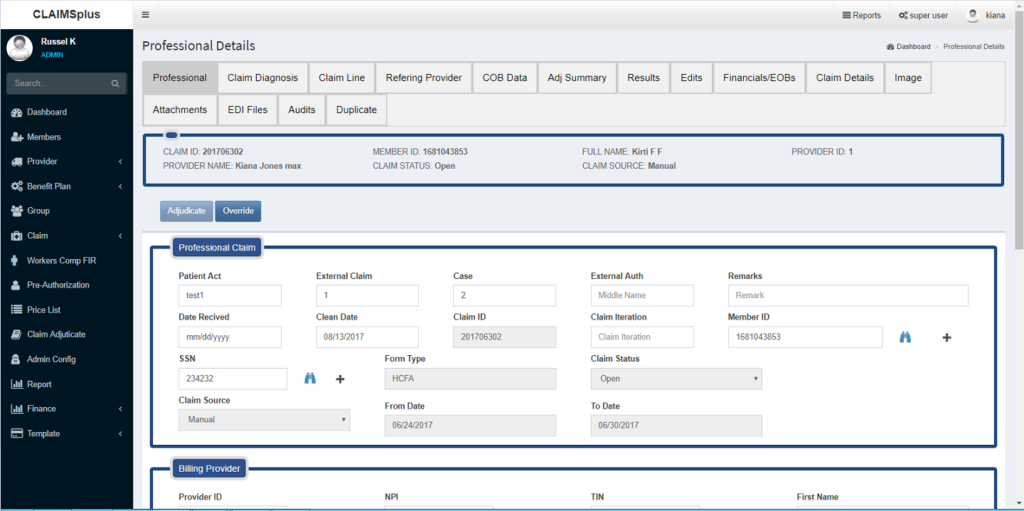

CLAIMSplus ensures excellence by enlisting our expansive software compatibilities and capabilities that align with medical insurance payment systems along with negating redundancies that slow payments down. Our robust electronic claims administration systems are tried and true, giving our clients the type of transparency and affordability that accelerate payments and get claims approved faster. Partnering with industry-leading Third-Party Administrators, insurance providers, employers and the like, CLAIMSplus reconciles billing discrepancies through automated adjudications that surpass industry norms, all the while boosting processes and healthcare payments that not only pay off—but pay fast.

Our comprehensive core claims administration solution is utilized by healthcare payers and TPAs who are serious about offering best-in-class advantages. The automated electronic tools developed by CLAIMSplus are designed to speed complicated healthcare claims.

WHAT CAN CLAIMSPLUS DO FOR YOU?

- Deliver robust claims management solutions

- Automate employee benefit plans

- Verify benefits’ offerings

- Customize automated systems for Healthcare Payer and TPA claims

- Eliminate duplicate billing

- Auto-flag inaccurate medical codes, or lack thereof

- Process and reimburse NJVCCO claims

- Tailor data analytics reporting

- Strictly adhere to filing deadlines

- Comply with HIPAA regulations and PID standards

CLAIMSPLUS ADVANTAGES

- Expedited claims processing systems that cut down on claims administrators’ manual efforts.

- Scalable networks that increase claims’ processing throughput, all the while placing you and your business on a robust path for growth.

- A strong data analytics platform that supports data-intensive applications for real-time analyses, reviews and reports.

- Fast claims eligibility processes through automated user tools including auto-calculate that propels processes and drives claim efficiencies.

- Data connectivity that produces automated emails, letters, and all related claims correspondence.

- Agile alignment of disability and leave claim information, including time used as well as time left.

- Staying put within one system as opposed to changing over between incompatible claims processing programs.

- Network-attached data storage (NAS) that combines distributed computing with sound claims processing software.

- FMLA and ADA claims sorting and processing that eliminates claims’ redundancy and inaccuracies.

- Customized claims solutions engineered to expedite payments that are on time and on point.

- Secure platform compatibility via complete processing integration for employee Disability and Absence claims.

- Enhanced processing accuracies due to split-second data scrubbing—cutting claims rejections way down!